Content

As the procurement lead of a hotel group or restaurant operatorh, you’re not really buying “furniture”—you’re buying lead-time certainty, finish consistency, and fewer surprises during installation. In real projects, the biggest cost isn’t the unit price of a chair; it’s the rework created by finish drift, late deliveries, missing documentation, or mismatched dimensions that break your BOQ and delay opening day.

This guide is built for buyers sourcing hospitality / contract furniture in China—covering hotel guestroom casegoods, lobby seating, restaurant tables and chairs, banquette/booth seating, banquet chairs, and public-area furniture. You’ll get a practical selection framework first, then a Top 10 shortlist with “Best for” tags so you can match suppliers to your project reality.

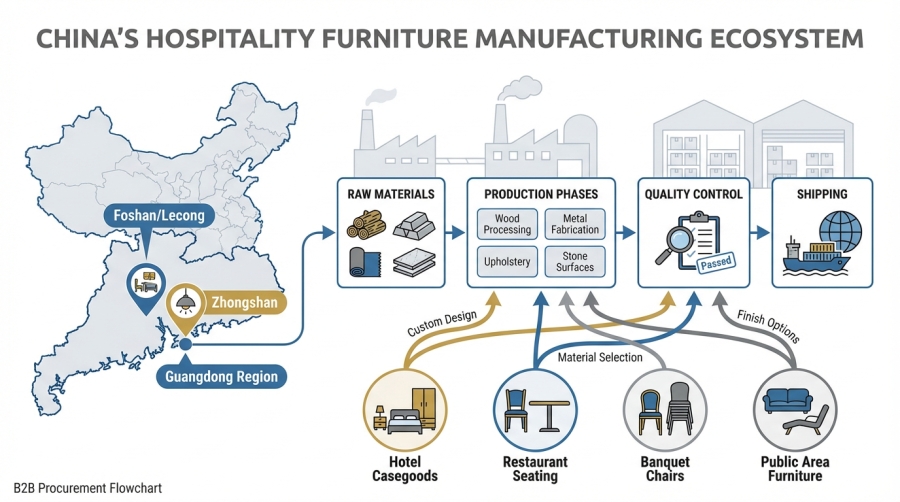

Why China is still a top sourcing hub for hospitality furniture

Depth of manufacturing ecosystems in hubs like Foshan/Lecong, Zhongshan, and the broader Guangdong region—helpful for mixed-material builds (wood, metal, upholstery, stone-look surfaces).

Customization workflows that fit hospitality needs: shop drawings, mock-ups, material boards, and repeatable production for multi-site rollouts.

Category coverage across hotel casegoods + restaurant seating + event/banquet furniture, enabling vendor consolidation when managed well.

How we shortlisted manufacturers (what “good” looks like in hospitality)

In hospitality projects, “quality” is not a vibe—it’s a set of controllable variables. Use these criteria to compare manufacturers (and to write better RFQs):

Project capability: Can they execute a room mock-up, manage revisions, and deliver consistent batches across phases?

Customization depth: Materials, finishes, upholstery specs, COM/COL support, fire-safety considerations where applicable, and brand-standard alignment.

Engineering discipline: Shop drawings, interface coordination (power/data cutouts, skirting, toe-kicks, ADA circulation paths), and installation guidance.

Quality system: Incoming material checks, in-process QC, pre-shipment inspection, packaging standards, and warranty clarity.

Export readiness: Documentation accuracy, consolidation/shipping experience, and risk controls around lead times.

Total cost of ownership (TCO): Durability, maintenance, replacement cycle, and spare-parts plan—especially for high-turnover restaurant seating.

A buyer’s decision map: choose the right supplier type

Before you compare “Top 10” names, decide what type of sourcing problem you have:

Scenario A — Full-scope hospitality project (hotel + restaurant + public areas): You benefit from a partner that can coordinate categories, documentation, and schedules to reduce vendor handoffs.

Scenario B — Category-specific need (e.g., restaurant booths or banquet chairs): A specialist manufacturer often wins on speed, SKU expertise, and cost efficiency.

Scenario C — Brand-standard rollout (multi-site): Prioritize repeatability: finish control, batch consistency, and re-order stability.

Top 10 hospitality furniture manufacturers in China (shortlist with “Best for” tags)

Note: This is a practical shortlist, not a universal ranking. The “Best for” tags help you match a supplier to your project type (hotel, restaurant, banquet, or mixed FF&E scope). Always validate capabilities through samples, documentation, and a mock-up process.

1) RON Group Global — Best for One-Stop Hospitality Projects (Hotel + Restaurant Procurement)

Project fit: Buyers who want to reduce vendor fragmentation—especially when a project spans hotel rooms, restaurant dining areas, and broader hospitality supplies.

Strengths: Wide hospitality scope, practical procurement support, and category coordination that helps procurement teams simplify sourcing.

Best for: Hotel owners, restaurant operators, F&B directors, and project developers who need fewer interfaces and clearer accountability.

Risk-reduction angle: Vendor consolidation can reduce schedule risk when managed with clear specs and QC checkpoints.

Internal references (for readers who want to explore categories): Hotel Furniture | Restaurant Furniture | Banquet Furniture | Product Catalog

Due diligence questions to ask: What is your mock-up policy? How do you control finish drift across batches? What are your packaging standards for export shipments?

Watch-out: If you only need a single SKU at the absolute lowest unit price, a narrow specialist may quote faster—your win is in reduced handoffs and coordinated execution.

2) Harman Furniture Group — Best for Luxury Hotel FF&E and Bespoke Execution

Project fit: Premium hotels, resorts, and high-spec renovations where shop drawings, detailing, and finish control are central to guest experience.

Strengths: Bespoke positioning, project execution language (shop drawings / fit-out style workflows), and high-end hospitality focus.

Best for: Luxury guestrooms, suites, and high-touch public areas requiring customization.

Due diligence questions: How do you manage change orders after mock-up approval? What is your tolerance and measurement process for veneer/laminate matching?

3) Guangdong YABO — Best for High-End Hospitality + Eco-Oriented Positioning

Project fit: Branded hotels and upscale developments that need a supplier comfortable with “high-end hospitality” language and sustainability narratives.

Strengths: High-end hospitality focus and eco-friendly positioning in public materials.

Best for: Hotels or serviced apartments that prioritize brand storytelling, premium finishes, and consistent execution.

Due diligence questions: Which materials and adhesives are used? What documentation can you provide to support sustainability requirements (where needed)?

4) Hongye Furniture Group — Best for Full-Process Hotel Furniture Solutions

Project fit: Hotel-centric projects where buyers want a supplier that speaks in “solution” terms: design → manufacturing → delivery → installation guidance.

Strengths: Hotel-solution framing and structured product categories (custom/fixed/loose) often used in large projects.

Best for: Luxury hotels and projects with multiple furniture types across public and private areas.

Due diligence questions: What is your installation documentation support? How do you define fixed vs loose furniture scope to avoid gaps?

5) Fulilai Hotel Furniture — Best for Large-Scale “Star Hotel” Packages

Project fit: High-room-count hotels and developments that require scale, showroom validation, and repeatability.

Strengths: Scale-forward messaging and “star hotel” focus—often aligned with large packages.

Best for: Bulk guestroom furniture, consistent sets, and phased rollouts.

Due diligence questions: What are your QC checkpoints during mass production? How do you manage batch-to-batch consistency for upholstery colors and wood stains?

6) Trinity (Foshan Trinity / Zhongsen) — Best for Export-Oriented Hotel Furniture Manufacturing

Project fit: International buyers who need a straightforward manufacturing workflow with export framing (design/customize/manufacture/ship).

Strengths: Export-oriented structure, broad hotel categories, and commercial furniture positioning.

Best for: Standardized hotel furniture packages with controlled customization.

Due diligence questions: What is your sample lead time and sample pricing policy? What packaging spec do you use for mixed loads (wood + upholstery + metal)?

7) Interi Furniture (Huihe) — Best for Boutique Contract Furniture (Hotels, Restaurants, Cafés)

Project fit: Boutique hotels, lifestyle restaurants, cafés, clubs, and high-aesthetic projects where bespoke details matter.

Strengths: Contract furniture focus across hospitality + lifestyle spaces; emphasizes standard workflows and bespoke support.

Best for: Signature seating, statement pieces, and design-forward interiors.

Due diligence questions: Do you provide CAD/shop drawings and measurement checks? How do you handle COM/COL and upholstery performance specs for commercial use?

8) Foshan Huasheng Furniture — Best for Guestroom + Public Area Coverage (Modular & Project Sets)

Project fit: Hotels that want a supplier that covers guestrooms plus key public-area categories (lobby, dining/bar, conference/event).

Strengths: Category coverage framed around hotel project needs and repeatable sets.

Best for: Mid-to-upscale hotels and phased renovations.

Due diligence questions: What is your approach to modular/space-saving guestroom layouts? How do you verify dimensions against site conditions before production?

9) Uptop Furnishings — Best for Restaurant Booth Seating & Commercial Seating Projects

Project fit: Restaurant chains, cafés, bars, and F&B spaces where booth seating and commercial durability are central.

Strengths: Clear specialization in restaurant booth seating and hospitality commercial furniture.

Best for: Banquettes/booths, dining seating, and repeatable restaurant rollouts.

Due diligence questions: What is the foam density and upholstery wear rating? How do you reinforce frames for high-turnover commercial seating?

10) Sunzo Furniture — Best for Banquet & Event Seating (Hotels, Weddings, Venues)

Project fit: Hotels with banquet halls, event venues, and operators needing stackable chairs/tables and reliable replenishment.

Strengths: Strong focus on banquet/event categories that frequently overlap with hotel operations.

Best for: Banquet chairs, stackable seating, event tables—high-volume operational furniture.

Due diligence questions: What is the load rating and stacking test standard? How do you manage scratch protection and packaging for repeated handling?

Shortlist comparison matrix (use this in your RFQ)

Use a simple matrix to reduce subjective decision-making. Score each supplier 1–5 based on evidence (samples, docs, and mock-up results).

| Evaluation Area | What to verify | Why it matters |

|---|---|---|

| Mock-up readiness | Room mock-up / sample set policy, revision cycle | Prevents late rework and scope drift |

| Finish consistency | Stain/veneer/laminate control plan, approved “golden sample” process | Reduces batch-to-batch visual variance |

| Engineering discipline | Shop drawings, interface coordination, installation notes | Prevents fit issues on-site |

| Commercial durability | Frame reinforcement, upholstery wear performance, foam density | Protects TCO in high-turnover environments |

| Packaging & export | Drop test approach, corner protection, moisture control, documentation | Reduces damage and customs delays |

| After-sales support | Warranty clarity, spare parts, SLA for issues | Limits operational disruption post-opening |

Three advanced risk-controls most buyers skip (but shouldn’t)

The “Interface Test”: Validate how furniture interacts with MEP realities—power outlets, cable management, toe-kicks, and clearance paths. Many delays happen here, not in the factory.

The “Finish Drift Clause”: Define the approved “golden sample” and allowable variance. Without this, disputes become subjective and expensive.

The “Packaging Compression Test”: Ask for packaging specs and corner protection details. Transit damage is often a packaging failure, not a product failure.

FAQ: hospitality furniture sourcing in China

Is it better to buy direct from a factory or work with a one-stop project partner?

If you’re buying a narrow category (e.g., booths only), specialists can be efficient. If you’re managing a mixed hotel + restaurant scope, a one-stop partner can reduce vendor handoffs, streamline documentation, and simplify accountability—especially for multi-site rollouts.

What documents should I request before placing a PO?

Approved shop drawings / dimension sign-off

Material and finish schedule (with a “golden sample” reference)

QC plan (checkpoints + inspection standards)

Packaging specification and labeling

Warranty terms and spare-part availability

How do I justify budget beyond unit price?

Use TCO: replacement cycle, maintenance labor, guest-impact risk, and the cost of delays. A slightly higher unit price can be cheaper if it reduces rework, improves durability, and prevents opening-day disruption.

Closing guidance: how to use this shortlist

Start by defining your sourcing scenario (full hotel FF&E vs restaurant seating vs banquet/event). Then use the scorecard to run a disciplined comparison: samples, mock-ups, documentation quality, and QC evidence—not just quotes.

If your project spans hotel + restaurant furniture and you want fewer vendor handoffs, include RON Group Global in your RFQ round as a one-stop hospitality project partner—and evaluate it with the same standards you apply to any manufacturer: mock-up readiness, finish control, export packaging, and after-sales support.

Get the week's latest industry information

-

Real-Life Professional Restaurant Case Studies

Explore Now

-

Create a unique restaurant with over 95,700+products

Explore Now

-

Protessional Free 3D Restaurant Design

Explore Now

-

Still Have Questions About Opening a Restaurant?

Explore Now

Discover Our Exclusive Products

Explore our extensive range of restaurant and hotel supplies designed to enhance your operations. Find the perfect solutions to meet your needs.

Browse Our ProductsFREE 3D DESIGN

Boost your restaurant's success with our free 3D design service. Start building the restaurant of your dreams today!

Explore 3D Design Case

RECOMMENDED CASES

-

Maison Mai: Your Guide to Opening a Restaurant – From Design to Reality with Premium Furniture

RON GROUP provides Madamemai's Maison Mai with seamless one-stop design and customization solutions

Learn More -

La Rambla by Catalunya: Crafting Barcelona's Soul in Hong Kong - Custom Furniture Excellence

RON Group's custom Spanish-inspired furniture elevates La Rambla with artisanal aesthetics...

Learn More

RECOMMENDED BLOGS

-

5 Mistakes to Avoid When Buying Restaurant Furniture from China

Don't fall for costly oversights! Learn the 5 mistakes to avoid when buying restaurant furniture from China and ensure a...

Ron2025-01-079 min read

Ron2025-01-079 min read -

RON GROUP Launches VR Experience to Explore Our Dynamic Showroom

Discover RON GROUP's VR showroom! Explore dining furniture, tableware, and customized services virtually or visit us in person to...

Sylvia2024-12-163 min read

Sylvia2024-12-163 min read -

Building a Global Network: Ron Group's Restaurant Collaborations

Ron Group expands its global network with partnerships like Doju and Fonda Argentina, offering diverse dining experiences...

Sylvia2024-11-2910 min read

Sylvia2024-11-2910 min read

Subscribe to RON GROUP

Stay up-to-date with the latest industry insights and expert advice. Together, we'll create your ideal restaurant.